In today’s competitive business environment, a company’s understanding of its market share can make or break its success. Market share refers to how much business one company gets compared to the market and its competitors. It is a crucial metric that helps provide valuable, actionable insights into the company, its market, and future growth potential. By understanding its market share, a company can assess its performance and target opportunities for growth.

But why is knowing market share so important? It is the only metric that shows how a company is positioned in the market relative to its peers. In other words, market share tells how much a company is winning or losing. Additionally, tracking market share over time is the best way to judge the effectiveness of business strategies.

In this article, we will cover market share, why it is important, how to calculate it, and how to positively affect it. It doesn’t matter if you are a seasoned industry veteran, an analyst fresh on the job, or need help with consulting case interviews – this guide has what you need to get started.

What is market share?

Market share is a fundamental concept for all businesses that represents a company’s relative place in the market. To define, we can look at the two words that make it up: Market and Share.

Market – the total opportunity for all companies, defining how big the pie is for all competitors

Share – a simple percentage expressing how big a piece of the pie each competitor has

Putting those two together, we get a simple definition:

Market share is the percentage of an industry’s sales that one company controls.

For example, if a market is $10 million per year, and Company A has revenue of $3 million in that market, then Company A has 3 / 10 = 30% market share that year.

Market share calculations are often simple math but with lots of complicated assumptions to get the market size. The market size may be expressed in dollars, items, or other units, expressing the total size of a market. For example, a cell phone carrier may look at the amount of dollars spent on wireless coverage (dollars), the number of cell phones in use (items), or the number of people under their service area (other).

One limiting factor of market share is that it is a value at a point in time. Therefore, it is important to track market share every year or quarter. This lets businesses analyze changes in market share to asses how their strategic initiatives worked relative to the market. Monitoring over time also helps identify new trends, customer behaviors, and new growth opportunities that allow a business make data driven decisions.

Why is market share important?

Understanding market share is helpful for many reasons, but mostly because it is the most useful metric to show how much a company is winning or losing in the market. A large market share suggests that a company is a market leader. They meet their customer needs the best, have a great product, and retain customers. These companies also benefit from having a diverse customer base, strong brand reputation, and benefit from economies of scale.

Market share is one of the pillars of strategic planning. Monitoring market share gives businesses insights into how they are doing today relative to their competitors. Also, trending market share over time lets businesses see how their strategy has affected their market position. This information allows business leaders to make data driven decisions around their market strategies, product offerings, and target geographies. For example, if a business sees its market share go down over time, it may look to see what the competition has done to take its share.

Also, market share is an important metric for investors and stakeholders. A growing market share suggests that a company can beat the market. They may get more revenue and profitability than their peers, which would be a good investment. Also, investors may look for companies with a small market share since that means the company has a lot of opportunities to grow within their market, and investing in sales and marketing may lead to outsized returns. Conversely, declining market share may raise red flags. This could lead investors to think that a company has an outdated product, a losing go to market strategy, or other strategic decisions that did not work.

How to calculate market share

Calculating market share is very simple and follows a simple formula. The easiest way to do it is to take a company’s sales in a year and divide that by the total sales in the market over the same period. The simple formula below

Market Share = Company Sales / Total Market Sales

For example, the market for a hypothetical product has 3 companies that participate: Company A has $3 million in sales, Company B has $5 million, and Company C has $2 million. The market share for Company A is 30%

Company A Share = 3 / (3 + 5 + 2) = 3 / 10 = 30%

By this same formula, Company B has 50% market share, and Company C has 20% share. The fundamental principle is the same: compare a company’s activity to the activity of the entire market.

Calculating market share is not always straightforward, mostly due to the difficulty of estimating the market size. Reality will very rarely be like the example above, with few competitors holding a strong share and publicly available sales information. For this reason, perhaps the most difficult part of calculating market share is estimating market size.

Factors Affecting Market Share

Several factors can affect a company’s market share, ranging from external factors that are out of its control to internal strategies that are totally within its control. Understanding the different factors and their impact on business is needed for a company to improve its market share position.

Competition

Competition is one of the main factors affecting market share. Since, quite literally, the competition is who is competing for every bit of market they can get. The number of competitors also affects market share. A company would expect to have a low share in a highly fragmented market with many competitors unless one or two companies have a dominant position. Conversely, a very concentrated market would imply that each competitor has a large share. Copmanyies that can identify their key competitors and their market share are on their way to positively affecting their own market share.

Customer Behavior

Customer behavior is another important factor. As a company, we believe that customers think about our products the same way we do—that we are the best! But in reality, customers are as diverse and bring different preferences, trends, and purchasing habits that affect who they spend their money with. For example, more environmentally conscious customers may choose a product because of its perceived lower carbon impact, like electric cars. A company must be able to identify trends and changes in customer behavior to capture maximum market share.

Brand Recognition

Many companies may rely on their brand to maintain a dominant market share position. Think about how you may associate a brand with “quality” or “best in class” or “value for the money”. These are all ways that brands use the customer’s history with the brand to maintain market share. This is especially true in concentrated markets with few brands, it is very hard for a new entrant to gain credibility and market share. Conversely, new brands may use their novelty to get market share as a disruptor of a legacy product, especially in highly fragmented markets.

Politics

Political factors are largely out of the company’s control. These may include tariffs, trade wars, and embargoes. What type of market share would you expect a company to have if it is not allowed to sell in the United States? It would probably be much lower than if it were allowed. But is it fair to consider that part of the market when calculating market share? Probably not! For that reason, it is important to isolate the different political factors out of your company’s control when calculating market share. This is why marketers look at Total Addressable Market (TAM), Serviceable Addressable Market (SAM), and Serviceable Obtainable Market (SOM).

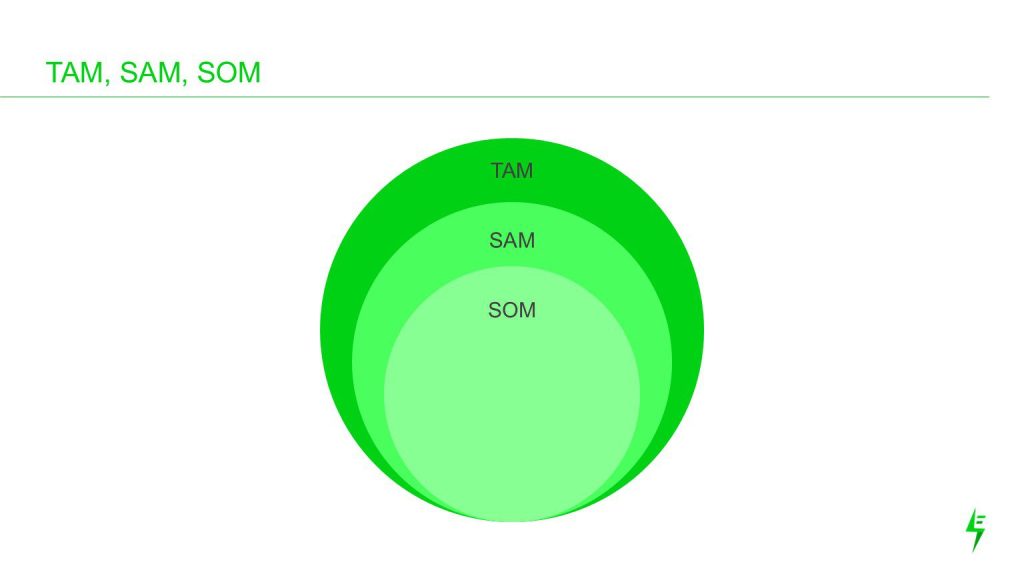

TAM, SAM, and SOM

The TAM, SAM, and SOM are the three ways a company can segment a market it participates in. Each one pulls out different bits of the market that, while important and real, may not be where the company wants to dedicate sales resources.

In general, we think of it starting with the Serviceable Obtainable Market (SOM)—this is the core part of the market that the company does business in. The sales team is willing and able to participate here. The SOM is where the most meaningful market share data will come from and should drive tactical business development decisions today.

The Serviceable Addressable Market (SAM) is the next layer. If the company develops a new product or solution for this part of the market, it could sell here. We generally think of this as where management should focus on new product development and geographical expansion efforts.

Lastly, the jump from SAM to the Total Addressable Market (TAM) will come from including all products, all markets, and all geographies in the total number.

We will use an example of a women’s prom dress company based in the USA. To go from TAM to SAM to SOM

TAM – there are 8 billion people in the world that could wear clothes

SAM – there are 168 million women in the USA

SOM – there are 11 million women aged 15 to 19 in the USA. If we assume that only the 18 year olds (seniors in high school) attend prom, then 1/5 of the 11 million, or 2.2 million dresses will be bought this year.

See how we went from a TAM of 8 billion people in the world, to 2.2 million high school seniors in the USA! If your company sold 100,000 prom dresses, you would have 4.5% of the SOM, but 0.00125% of the TAM. Which one do you think is more useful for making business decisions?